- Introduction

- Interview with Ernst Fehr

- Highlights from the report

- Download the report

- In the media

- About the authors

- Request data

The Nobel laureate Bengt Holmström shows the objective behind performance compensation in his scientific work. This compensation should help force management to make decisions in the interest of the shareholders. This is not always the case, however: management often has advance information and only has limited interest in giving this up in various situations. Bengt Holmström offers a solution for this problem by showing how performance based compensation can align the interests of shareholders and management.

Where Holmström developed a solution in theory, Prof. Ernst Fehr of the University of Zurich is now putting this into practice: a performance based management compensation, a so-called “pay for performance” logic 11. The current discussion on management compensation, however, leads to the conclusion that such a “pay for performance” logic has not yet been realized in all firms.

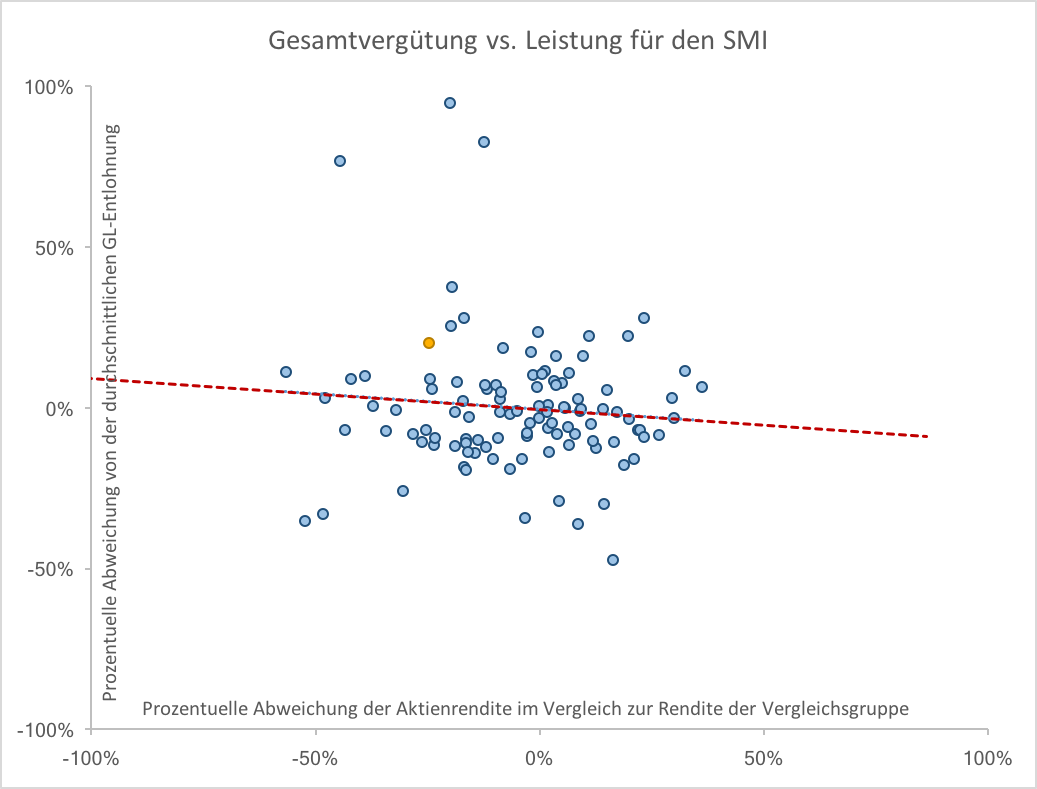

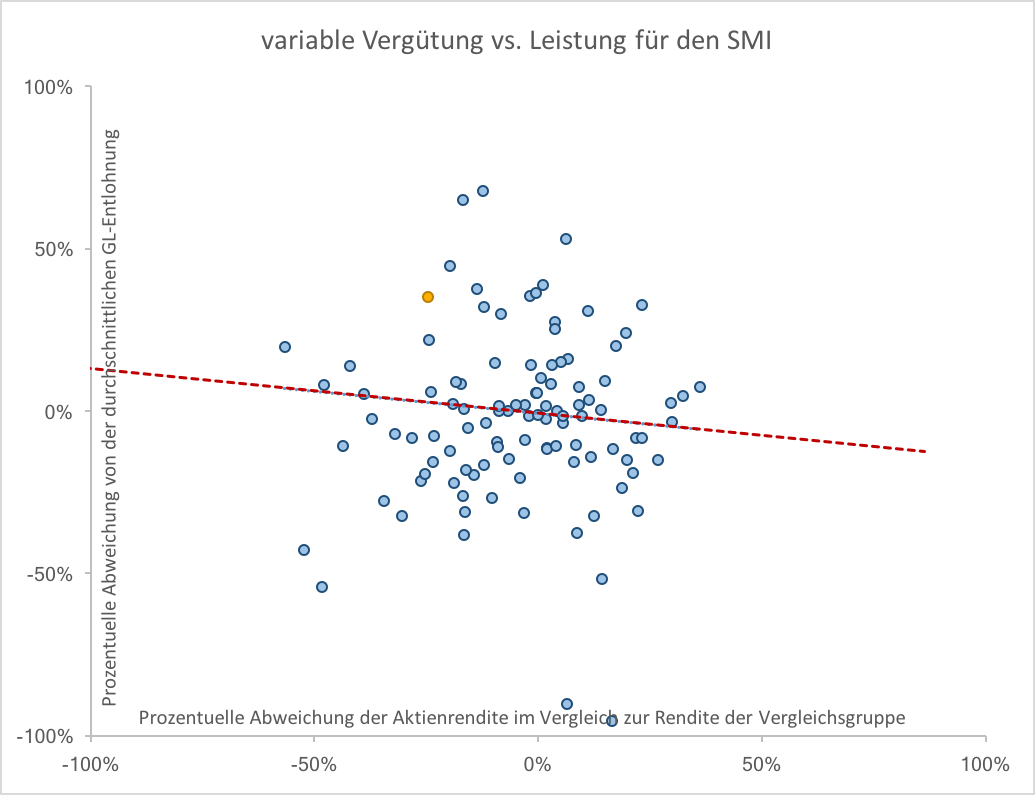

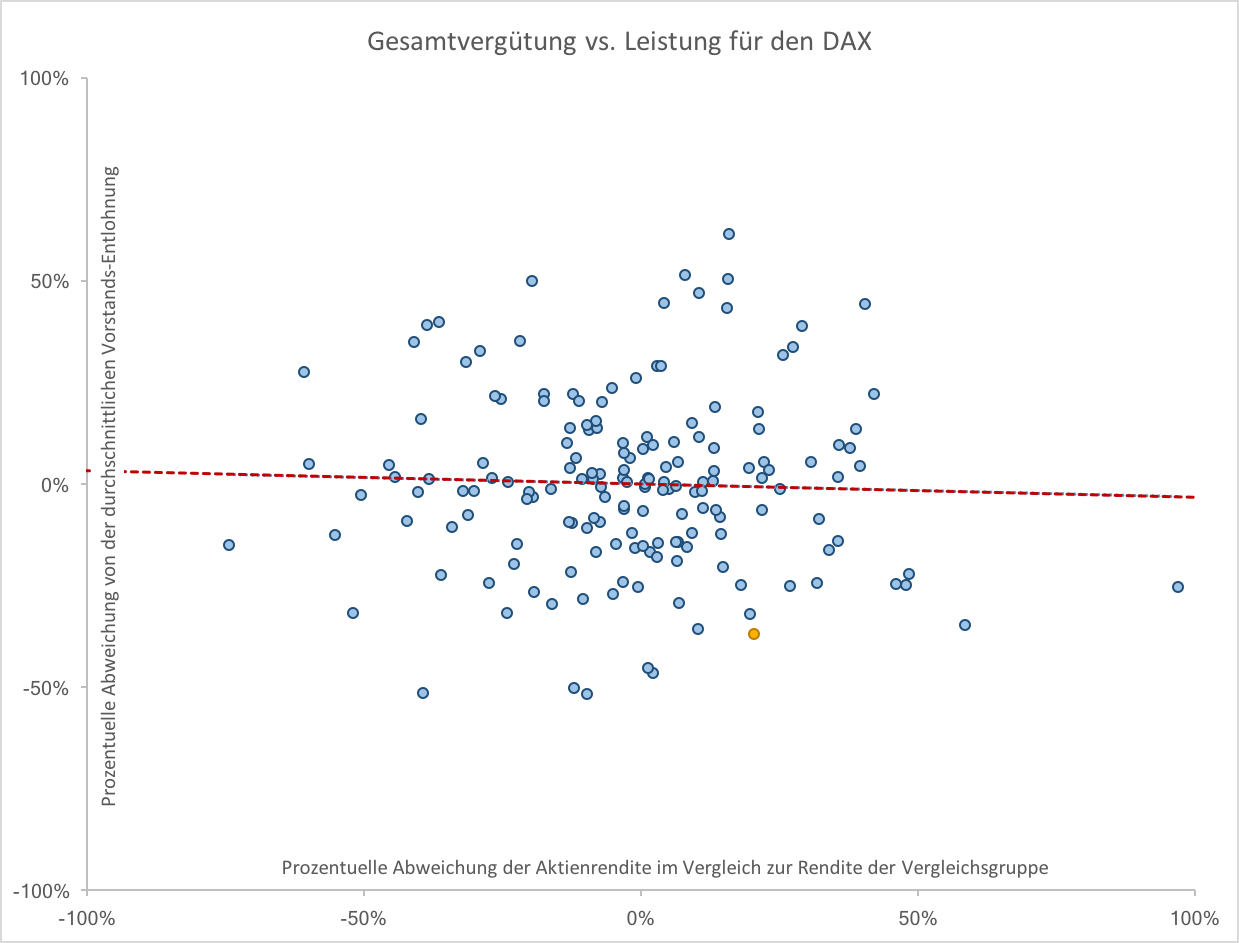

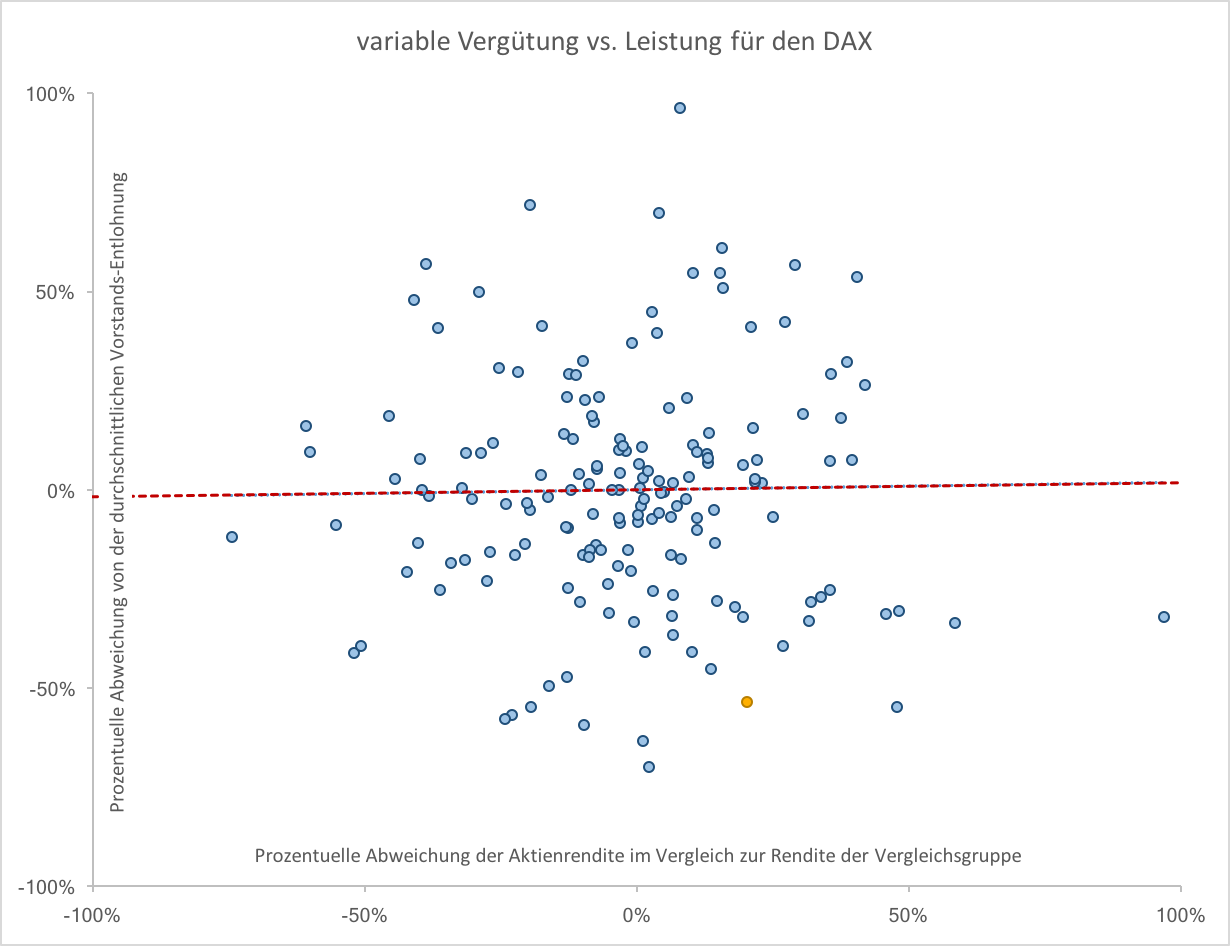

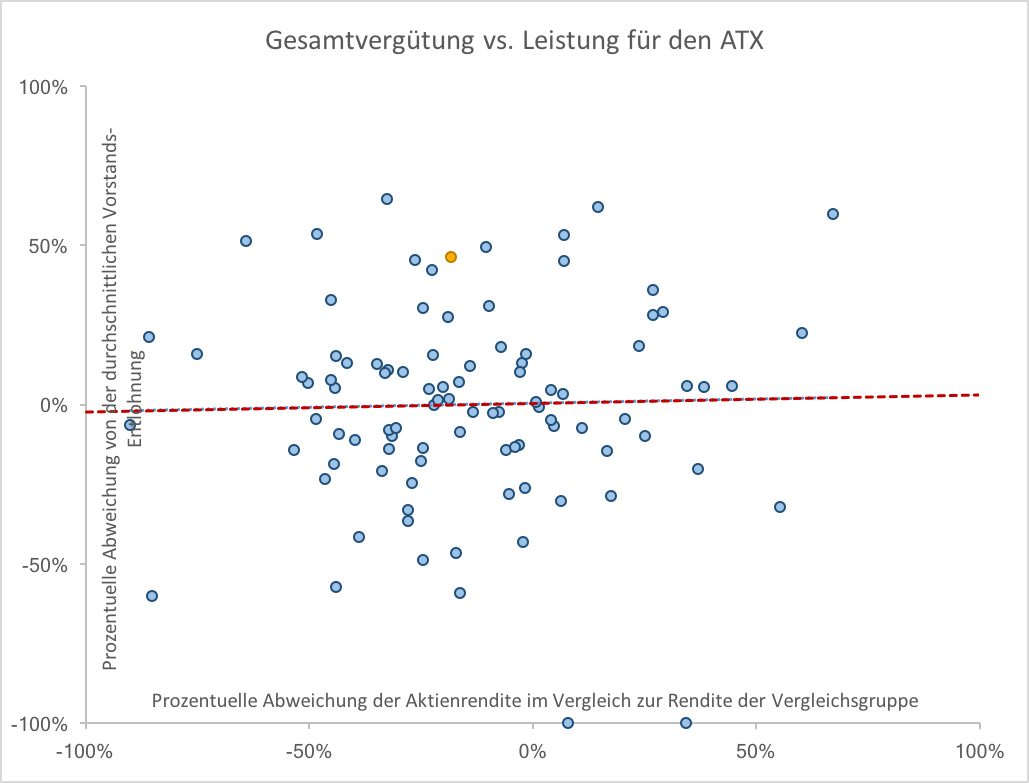

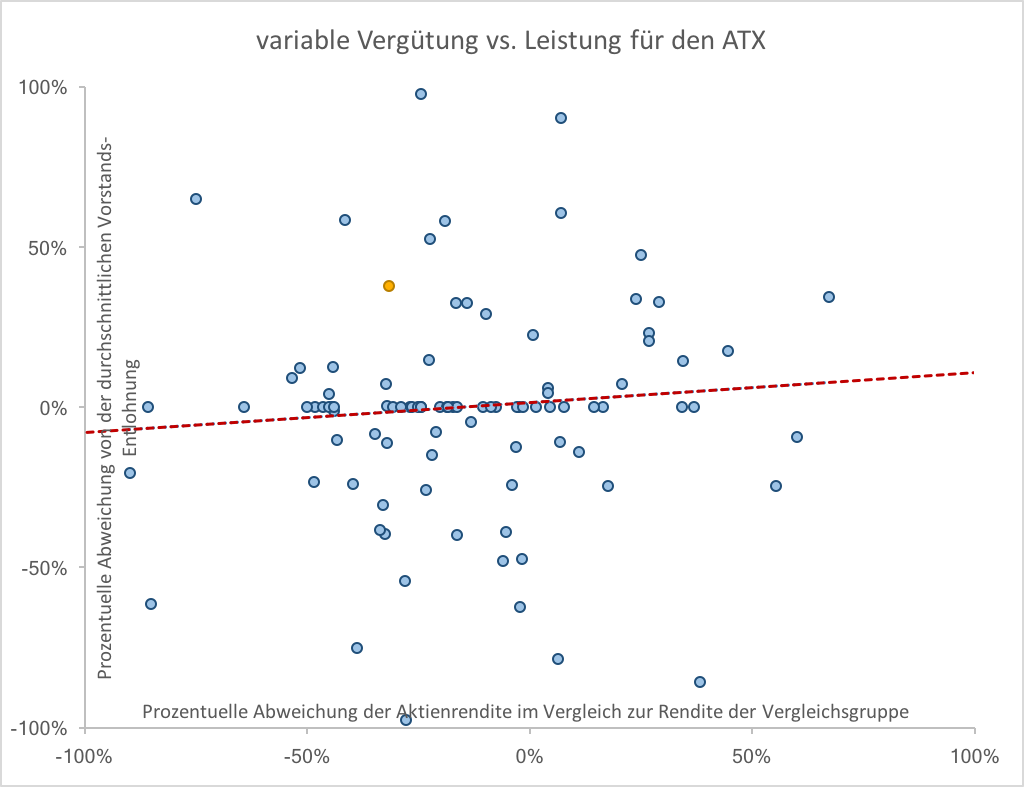

The “pay for performance” study from FehrAdvice presents a systematic discussion in this area. It examines whether the feelings of the populace, the recommendations of proxy advisors, and the statements of shareholders are reflected systematically in the markets (Germany, Austria, Switzerland), i.e. whether compensation and performance are actually in a recognizable relationship.

The results:

If we follow Ernst Fehr’s basic logic for pay for performance and good corporate governance, we can draw the conclusion that boards of directors in the German language area do not systematically harmonize the interests of management and shareholders with pay for performance contracts. As several recently published studies show, the lack of these incentives also has negative effects on an enterprise’s long-term performance, since the compensation system has a decisive influence on management’s strategic investment behavior.

Clear recommendations can be made from the results. The pay for performance logic of the existing compensation system should be examined regularly with a relative performance indicator. If unexplainable differences are apparent, we recommend revising the compensation system. Particular attention should be paid to the following

- Clear target salaries should be defined

- Not only compensation components, but also the performance components should be clearly named in the compensation report (performance transparency)

- Both short-term and in particular long-term components of the compensation system should be valued with a relative performance indicator.

Interview with Ernst Fehr (video, only available in German)

Highlights from the report to be clicked through

Read and download the report

In the media

- NZZ: Viele Unternehmen entlöhnen intransparent

- NZZ am Sonntag: Ernst Fehr: «Lohn orientiert sich oft nicht an Leistung»

- NZZ: Schluss mit den Lohndisputen

- tagesanzeiger: «Lohn orientiert sich oft nicht an der Leistung»

- 20 Minuten: «Lohn orientiert sich oft nicht an der Leistung»

- watson: Verhaltensökonom Fehr kritisiert Lohnsysteme für Manager

- Blick: Verhaltensökonom Fehr kritisiert Lohnsysteme für Manager

- Die Presse: Sind Manager ihre Gagen wert?

- Südostschweiz: Verhaltensökonom Fehr kritisiert Lohnsysteme für Manager

- Basler Zeitung: «Lohn orientiert sich oft nicht an der Leistung»

- Finanz & Wirtschaft: Studie – Viele Unternehmen entlöhnen intransparent

- Bilanz: Managerlohn orientiert sich meist nicht an Leistung

- Handelsblatt Global: Why It’s Right to Be Mad About Executive Pay

- NZZ: Schluss mit den Lohndisputen

- Luzerner Zeitung: Managerlohn hängt selten von Leistung ab

- Langenthaler Tagblatt: «Lohn orientiert sich oft nicht an der Leistung»

About the authors

Gerhard Fehr, Partner

Gerhard Fehr is a graduate of the University of Vienna with a degree in economics. He is a trained journalist, and has more than ten years of management experience in investment banking, the media branch, and in the Swiss credit card market.

Marcus Veit, Partner

Marcus Veit is a trained musician and economist. More than 15 years of experience for Swiss and international clients make him a sought after discussion partner for politicians, managers, and scientists.

Alain Kamm, Senior Manager

Alain Kamm is a graduate of the University of Zurich in economics, with focus on experimental economics and behavioral economics. He is a sought after discussion partner for clients and colleagues, thanks to his extensive behavioral economics expertise and methodical knowledge.

Request data

The MAPI data for the last five years can be requested for journalistic content on management performance.

Boards of directors, compensation committees, and representatives of top management will receive access to the MAPI and compensation data for their firms upon request.

Contact: Sybille Nirk, FehrAdvice & Partners AG, Klausstrasse 20, CHF-8008 Zurich, Switzerland, +41 44 256 79 00